Notes and thoughts about personal finance management

May 31, 2021 21:16 · 2093 words · 10 minute read

This article is mainly based on one blog of Pro. Yiqing Xu. As I just started my first job from last month, I think it is important to get some ideas about planning future life, especially in personal finance.

In this article, I will translate the general contents and make comments and discussions (in blue colour) which are related to NZ young graduates situation.

Bascically, this article has five small parts: basic knowledge of finance management and investment, retirement account and tax, property investment and general suggestions.

This article might be useful for those whose salary below than $150,000 and have a stable income stream in three years. My salary is merely above NZ medium wage but there is never a ‘right time’ to start.

Basic knowledge of finance management and investment

First of all, let’s get one thing clear. The process of wealth accumulation is a shift from wage income to asset income. In the US, the income of young lecturers in colleges is usually in the top 10% (maybe 15%) to 1%. The study shows that from 1980s, the income of this group has grown significantly faster than that of remaining 90% of Americans based on income distribution. One of the key reasons is that their asset gained from investment and dividends of globalisation in addition to salary increment. Hence, for young graduates who are just starting out, the most important thing is saving money and investing these money apart from normal expense. Due to the compound interest of investment, the amount of money saved and whether it is invested can have a significant impact on the wealth of a person or a family in the long run.

The next thing is to distinguish good and bad debt. For instance, mortgage is a good debt, credit card debt is a bad debt. The former has a relatively low interest rate and corresponds to an asset with a stable long-term return (a house); the latter has a high interest rate and no corresponding asset (consumed). My opinion on credit cards has changed a lot since pandemic. Just make it simple and get one with cashback, like CITI Double Cash (2% back on all purchases).

For most families, the following two types of underlying investments are suggested: property and liquid assets such as funds (stocks) and bonds.

The majority of savings should be allocated in the following assets:

- Cash (for property downpayment and emergencies)

- Stocks, bonds or other investments (such as cryptocurrencies and gold)

- Retirement accounts (mainly because of tax benefits).

Cash is the best for liquidity, but most large US banks offer interest rates close to zero on Saving Accounts. I have a Serious Saver account provided by ANZ, that the annual interest rate is 0.2%. If you try Term Deposits, the interest rate is around 1% for 18 months.

Bonds are low risk and low yield, averaging 3-5% over the long term (about the same as inflation rate).

Stocks have a high average return relative to bonds, as well as a high risk. In the US, the long-term average return on stocks is between 7-10% (caculated before inflation).

Cryptocurrencies such as Bitcoin are more volatile and long-term returns are debatable (I personally believe that Bitcoin has a similar value retention feature to gold). Gold has a safe-haven function, and long-term returns are also debatable.

The prevailing view in academia is that people should invest in both stocks and bonds, depending on their risk appetite. However, if your salary income is relatively high and stable, and may tolerate significant fluctuations in investment returns over a year or two, or even three years, then you should be more involved in the stock market, as stocks offer higher long-term returns.

Be aware of your tax on your profolio entities. Check details on Inland Revenue.

Retirement account and reasonable tax avoidance

Since you can only join in KiwiSaver when you are NZ permanent residency or citizens, so you can skip this for those who are not right now.

Owned housing and investment housing

I have written that you should consider buying a home when your job in the US has stabilized. There are four main financial reasons for this:

- In the US, there are substantial tax benefits to owning a home.

- Interest rates are currently very low and in many cities it is more cost effective to buy a home than to rent (careful calculations are required).

- Buying a home requires a downpayment and a monthly payment. Once the downpayment is paid and the monthly payment is set, you can have a clear plan for your other investments.

- Making a monthly payment is compulsory savings. For those who are not used to saving, buying a home can avoid the behavioural risk of not being able to save.

If you have not yet bought a home, you should consider the local property boom and your personal circumstances. The following factors are favourable for buying a property:

- The local property is more valuable - e.g. there are good education resources around or the ratio of house price-to-renting fee is low; In March 2021, the medium ratio is 32.1 in NZ where the highest (40.3) of North shore, Auckland; the lowest (21.2) of Invercargill. New York: 37.25, Shanghai: 49.53, Berlin: 29.71. I just listed some cities I am interested in, not meaning the highest ratio in each country.

- A large interest deduction on personal tax;

- A plan to hold the property for a long time (5-7 years or more);

- The ability to lock in a low interest rate;

- Employer has an incentive or subsidies when you buy a house;

- The value of the property can be fully utilised (e.g. no rooms are left vacant for long periods).

Conversely, it is more advantageous to rent. Combining all of these factors, it is often better to buy your first home than to rent. My opinion is that if I plan to stay in one city for over 5 years, I will buy an affordable house or small apartment for finance and life quality aspects.

A few reminders:

-

Like the stock market, house market also has a distinct cycle. However, unlike the stock market, the cycles of house market are longer and will not suddenly disappear. Buying a house at the bottom of the cycle is a shortcut to wealth accumulation. This is more important for investment housing. For people who have not bought first house, they may not be able to wait that time point.

-

Although the US house market has been good for a few years, the long-term return on house investment, excluding taxes and fees, is about 3%, which is much lower than the stock market. If you have leverage (e.g. 20% downpayment, i.e. 5 times leverage), the long-term return can be 10% or more per annum. As leverage decreases, so does the yield. This is why, if the property has increased in value after a few years, people usually refinance to take some of the cash out, maintaining a certain level of leverage and long-term yield.

-

The flip side of leverage is, of course, risk. However, the good thing about property is that there is no margin call. You won’t be asked to pay back the full amount because the price has fallen. As long as your cash flow can support your monthly payments, it doesn’t matter how much the price drops in the short term. The key to buying a home is to calculate your cash flow.

-

The transaction costs of a house are high, with each transaction costing 5-7% of the value of the property. This is why real estate should be a long-term investment

-

If you plan to sell one property and buy another, remember to make Section 1031 arrangements in advance (do a search if you need to) to avoid being charged capital gains tax.

Stocks, bonds and other liquid assets

This area is probably the one that concerns people the most, but it is also the one that has the least to talk about. First, I am not a professional; and second, because almost all academic studies show that for most people, buying index funds is better than stock picking in the long run. Surely it is the case in the US as the stock index is up in the long run.

My own views have changed. At first, I believed firmly in the results of academic research and put all my investments in index funds (that is I bought a basket of stocks on a regular basis, such as the S&P 500 SPY or the Nasdaq QQQ). Later, I learned something related to value investing and started buying some long term stocks that I was very bullish on (both Chinese and US stocks). Then later, unable to resist the temptation, I bought some popular technology stocks by hearsay. This year has been exceptional and all three investments have achieved good returns so far. But I know that there is a very strong element of luck involved, especially in the third situation.

A good friend of mine is a derivatives investor in Wall Street. He said investing is binary either spend a lot of time doing research which also require your intelligence, luck and personalities or spend no time (seting a fixed plan or randomly investing). I think he is absolutely right.

For all newcomers to the stock market, I would recommend J. L. Collins’ presentation on Google: The Simple Path to Wealth. His advice is to invest in index funds on a fixed basis. I know that even if all the research so far shows that he is right, most people will deviate from his advice. Because - most people believe that they are a little smarter, a little more discerning, a little more knowledgeable about a particular market than others - that’s human nature. And a short term profit will make you believe this even more.

I couldn’t get over this mentality myself, so I made myself a rule. Half of my income, excluding the monthly house payment, is invested in index funds (such as SPY, QQQ, etc.) The remaining half is invested actively, with at least half in a small number of good quality blue chips and half in more risky but bullish fast growth stocks (in fact, you can also just buy tech ETFs like ARKK, which I feel are overvalued currently). And, for the active stock investment, only buy when it’s down and generally I don’t sell.

I did this as a compromise with my weaknesses and an nature of loving gambling. Maybe in the end, only buying index is the best choice. Bonds are basically same as cash saving. Now I am only investing in ETF with fixed plan of about 12.5% of my salary.

Conclusion

I just put some confident tips here: (1) Open a high-interest deposit account and move most of your cash from major banks to it (keep a small amount for ATM withdrawals).

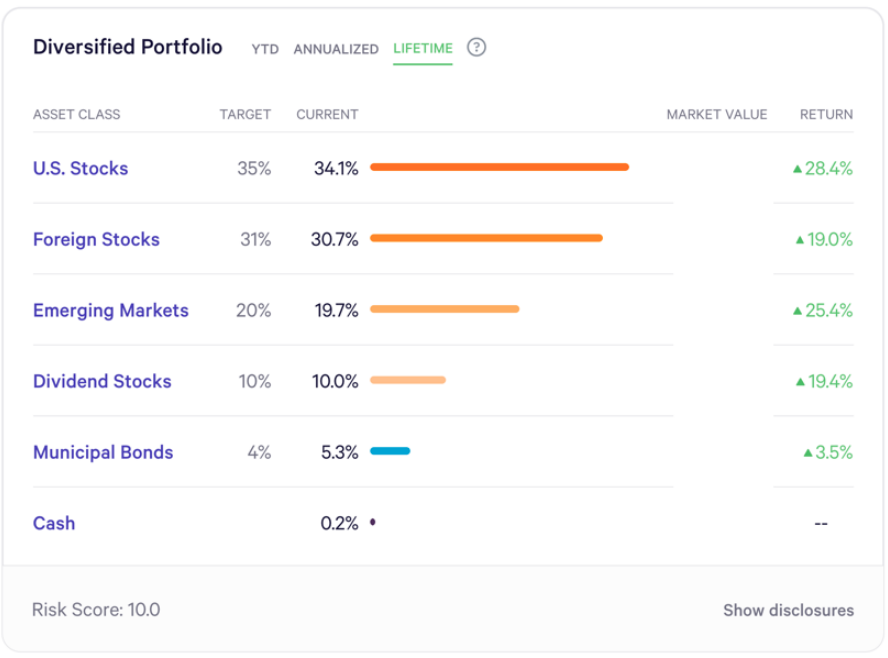

(4) Set up a personal investment account to invest a fixed portion of your monthly after-tax income. This can be done at any brokerage firm or use the Robot Advisor. Robot Advisor is better suited for rookies. It can automatically buy various funds based on your risk appetite.  Here RETURN does not mean profit rate

Here RETURN does not mean profit rate

(5) Of course, you can also buy and sell shares with brokers. With regard to investing in stocks, remember Warren Buffett’s two principles.(1) don’t lose money (2) remember the first principle. To do this without losing money as much as possible, you should ask yourself two questions when buying stocks: firstly, in the long run, are you buying a good company and secondly, are you buying at a good price.

Short selling and investing derivatives are not recommended for rookies - although the internet is full of people who have made a lot of money in the short term through these high-risk operations.

If you had considerable savings so dollar-cost averaging is a good method to give a trail. However, time in the market is also important. The project simulated by students of Xu showed that the optimal way is to invest your savings in first ~3 months.

What I have learned so far is:

- High return usually means high risk, keep that in mind

- The main aim of finance management is to make plan for future, not to make big money from it

- Never overestimate the sunk cost and underestimate your opportunity cost. Invest yourself in new skills, social networks and your health, the return is way more than that from finance investment.